New 2026 SBA Loan Rules: What They Mean for Green Card Holders and Non-U.S. Citizen Owners

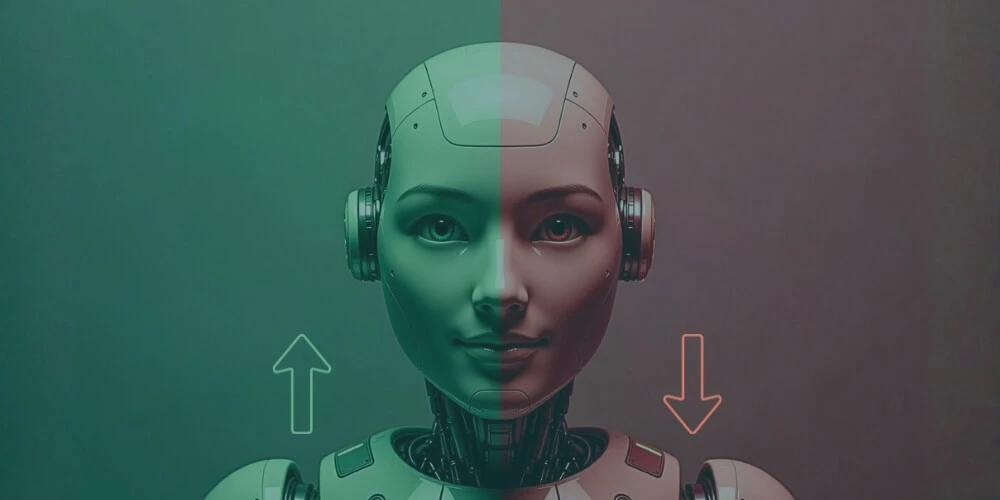

New 2026 SBA loan eligibility rules require 100% U.S. citizenship starting March 1st. See how this affects Green Card holders and your business's access to funding.