This is a summary from The Washington Post piece written by Tony Romm, Amy Goldstein, and Dino Grandoni / Published on Thursday, October 28th, 2021:

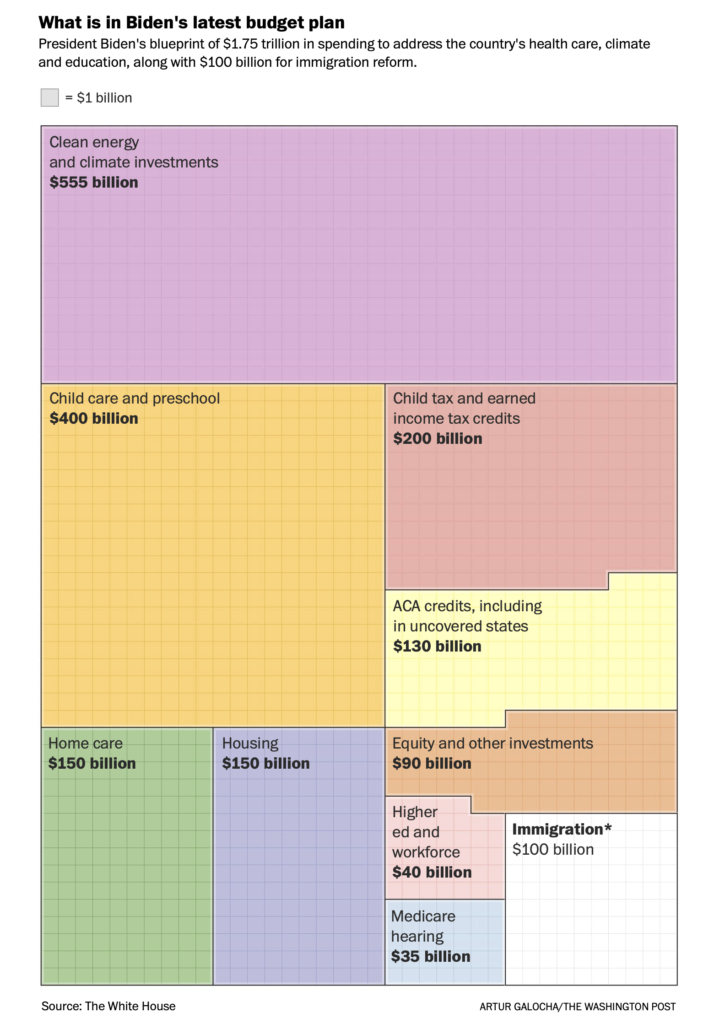

President Joe Biden unveiled on Thursday, October 28th, a $1.75 trillion new proposal that includes money for the country’s child care, health care, climate, education, and tax laws.

The plan includes some of Biden’s earliest policy priorities, including new spending to enhance child care and offer prekindergarten free to all American families. But it also shelved some of Democrats’ most fervent plans, including an effort to provide paid leave to millions of workers — one of many casualties in the party’s efforts to reduce its original $3.5 trillion price tag.