The Ever-Changing Landscape of BOI Reporting

Editor’s Note

This post is part of the ‘The GPCPAs Guides,’ an initiative dedicated to empowering you with the knowledge and strategies needed to navigate the complexities of the U.S. tax system and financial strategies. Visit our Information Hub, a curated resource offering the latest in tax, economic, and business news, alongside actionable guidance on tax strategies, accounting, and business advisory—because Planning Tomorrow, Together starts here.

By The Guillen Pujol CPAs Newsroom

Summary:

- Key Developments: BOI reporting requirements under the Corporate Transparency Act (CTA) have been paused and reinstated multiple times, with the most recent update halting enforcement as of December 27, 2024.

- Current Recommendation: FinCEN encourages voluntary compliance despite the pause, allowing businesses to stay ahead and avoid potential future enforcement issues.

- BOI reporting Updates– Next Steps: This article provides a timeline of updates, a compliance checklist, and expert guidance to help businesses navigate the uncertainty and prepare effectively.

Happy New Year readers. We are happy to share the final update on BOI reporting of 2024.

The Beneficial Ownership Information (BOI) reporting requirements under the Corporate Transparency Act (CTA) have been subject to a series of legal reversals, creating confusion for businesses navigating compliance. These BOI reporting updates are critical for understanding how businesses should prepare for potential enforcement resumption, despite the current pause.

To ensure clarity, this article provides a detailed timeline of the latest developments, actionable steps to maintain compliance, and a compliance checklist for businesses.

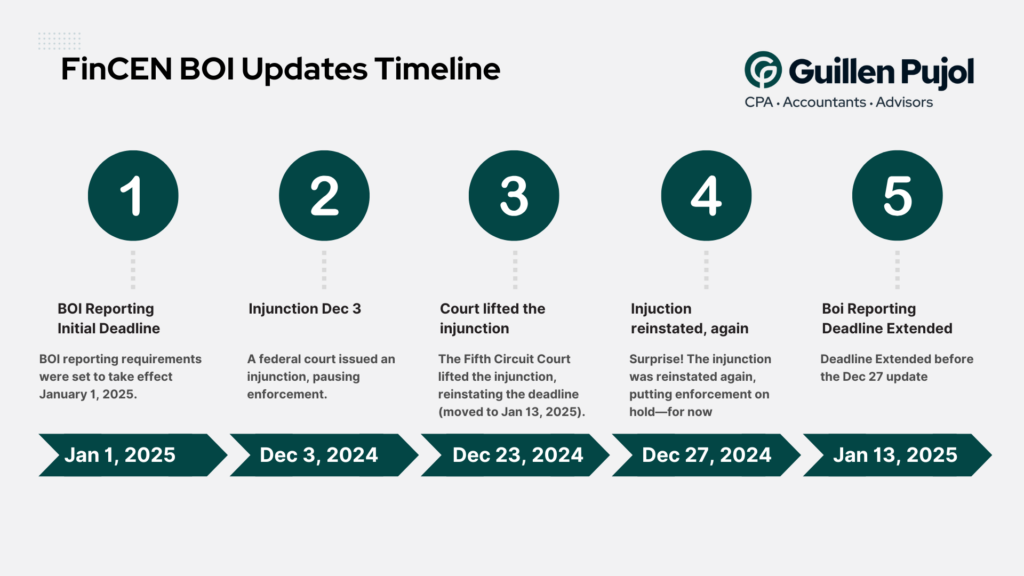

A Timeline of Key BOI Reporting Updates

Here’s a comprehensive timeline of the legal and regulatory changes surrounding BOI reporting updates and requirements:

- January 1, 2025: Initial BOI reporting deadline established for entities formed before January 1, 2024.

- December 3, 2024: A federal district court in Texas issued an injunction pausing enforcement of BOI reporting requirements, leaving businesses uncertain about next steps.

- December 23, 2024: The Fifth Circuit Court lifted the injunction, reinstating BOI reporting requirements and extending the deadline to January 13, 2025.

- December 27, 2024: The Fifth Circuit Court reinstated the injunction, halting enforcement of BOI reporting requirements once again.

These reversals underscore the fluid nature of BOI reporting updates and the importance of staying informed to avoid potential risks.

What Businesses Should Do Amid BOI Reporting Updates

While BOI reporting requirements are currently paused, FinCEN continues to encourage voluntary compliance. Businesses that proactively file their BOI reports can stay ahead of future changes and avoid last-minute complications if enforcement resumes.

At Guillen Pujol CPAs, we recommend all clients take the following steps to ensure they remain prepared, regardless of ongoing legal developments:

- Determine if your entity is required to file under the CTA.

- Gather accurate Beneficial Ownership Information (BOI), including names, addresses, and ownership details.

- File your BOI report voluntarily to demonstrate a commitment to compliance and transparency.

- Stay informed about the latest BOI reporting updates and regulatory changes.

- Consult with experienced compliance professionals for guidance on navigating the complexities of CTA requirements.

Compliance Checklist: Navigating BOI Reporting Updates

To simplify the compliance process, we’ve included a handy checklist for businesses to follow:

- Assess Filing Requirements: Determine if your business is required to submit BOI reports under the CTA.

- Compile Accurate Data: Collect all necessary information on beneficial owners.

- File Voluntarily: Take advantage of this pause to ensure your BOI report is complete and ready.

- Monitor Legal Updates: Keep track of ongoing BOI reporting updates to adjust your strategy accordingly.

- Seek Professional Guidance: Partner with experts to mitigate risks and streamline compliance.

Read our FinCEN guides by clicking here.

Take Action Now: Planning Tomorrow, Together, with GPCPAs.

Trusted by Businesses Nationwide for Seamless BOI Compliance.

FinCEN Extends BOI Reporting

With hundreds of Beneficial Ownership Information (BOI) reports successfully filed, GPCPAs has established itself as a trusted leader in navigating the complexities of CTA compliance. Our extensive experience ensures a smooth and efficient process, providing you with confidence and peace of mind as you meet your reporting obligations.

Schedule a consultation today.

- How Realtors Can Reduce Their Taxable Income Through Smart Entity Selection and Advanced Tax Planning

- After the Shutdown: How IRS Cuts Continue Affecting Taxpayers

- IRS Tax Brackets for 2026: What Business Owners Need to Know

- Florida’s Hunting, Fishing & Camping Sales Tax Holiday 2025: A Guide for Shoppers & Businesses

- Navigating the ‘One Big Beautiful Bill’: Implications for Global Tax Planning