In May 8, 2023, Florida’s Governor Ron DeSantis affixed his signature to nearly 300 bills that had successfully navigated the channels of the Republican-controlled State Legislature during the legislative session. While approximately one-third of these bills have already taken immediate effect, the remainder is slated to take effect in the coming months of October or January.

In light of these developments, the Guillen Pujol CPA team has crafted a summary highlighting key laws that pertain to the realms of taxation or economics:

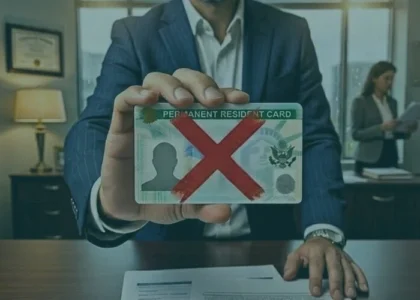

CS/CS/SB 264 — Interests of Foreign Countries [of Concern] like China, Russia, Venezuela, Cuba, Iran, Korea and the Syryan Arab Republic.

In a significant legislative move, Florida has enacted, with certain exceptions, new restrictions on property acquisitions within its borders. These impactful restrictions on individuals or entities with affiliations to ‘foreign countries of concern,’ including but not limited to China, Russia, the Venezuelan regime of Nicolás Maduro, Cuba, Iran, and the Syrian Arab Republic. This law prohibits:

1) It prevents governmental bodies within Florida from entering into contracts with countries of concern;

2) It bars such entities from engaging in contracts or agreements that offer economic incentives to these countries;

3) It restricts foreign principals of countries of concern from owning agricultural land and certain asset categories, such as real property close to military installations or critical infrastructure;

4) It significantly limits ownership by foreign principals from the People’s Republic of China.

With only minimal exemptions to these limitations, this bill is set to have a broad-reaching influence on the Florida real estate sector. Read the SB 264 summary prepared by the Florida Senate Judiciary Committee:

With respect to conveyances of real property in this state, the bill generally:

- Prohibits foreign principals from owning or acquiring agricultural land in the state.

- Prohibits foreign principals from owning or acquiring any interest in real property within 10 miles of any military installation or critical infrastructure in the state.

- Prohibits China, Chinese Communist Party or other Chinese political party officials or members, Chinese business organizations, and persons domiciled in China, but who are not citizens or lawful permanent residents of the U.S., from purchasing or acquiring any interest in real property in the state.

- Provides limited exceptions from the ownership restrictions for the purchase of one residential property that is not on or within 5 miles of any military installation in the state.

The bill also amends:

- The Florida Electronic Health Records Act, to require that the offsite storage of certain personal medical information be physically maintained in the continental U.S., U.S. territories, or Canada.

- The Health Care Licensing Procedures Act, to require licensees to sign affidavits attesting that all patient information stored by them is being physically maintained in the continental U.S., U.S. territories, or Canada.

Finally, the bill amends the statute criminalizing threats and extortion, to provide that a person who commits a violation of the statute, and at the time is acting as a foreign agent with the intent of benefitting a foreign country of concern, commits a first-degree felony.

These provisions were approved by the Governor and take effect July 1, 2023.

Vote: Senate 31-8; House 95-17

CS/CS/HB 1259 — Education

The Charter School Tax Revenue (HB 1259): The bill mandates school districts to allocate segments of local property-tax revenue to charter schools.

The bill revises the calculation methodology the Department of Education (DOE) uses to allocate state funds appropriated in the GAA to eligible charter schools. The bill specifies that state funds must be allocated on the basis of unweighted full-time equivalent (FTE) students and removes the additional FTE weight for students that are eligible for free and reduced lunch and students with disabilities.

- For Fiscal Year 2023-2024 – 20 percent.

- For Fiscal Year 2024-2025 – 40 percent.

- For Fiscal Year 2025-2026 – 60 percent.

- For Fiscal Year 2026-2027 – 80 percent.

- For Fiscal Year 2027-2028, and each fiscal year thereafter – 100 percent.

The bill adds reasons a charter school would not be eligible to receive capital outlay funds, if:

- The school is a developmental research (laboratory) school that receives state funding for capital improvement purposes.

- A member of the governing board, or his or her family member, has an interest in or is an employee of the lessor of the charter school property, unless the charter is a charter school-in-the workplace or a charter school-in-a-municipality.

The bill requires a charter school to attest in writing to the DOE, that, if the charter school is nonrenewed or terminated, any unencumbered funds and all equipment and property purchased with the public funds must revert to the district school board. Also, the bill requires purchases, lease-purchases, or leases by a charter school using charter capital outlay funds to be at the appraised value, defined as the fair market value to be determined by an independent, Florida-licensed, qualified appraiser selected by the charter school governing board.

Additionally, the bill clarifies that the calculation of each school district’s enrollment for purposes of calculating the proportionate share of the school capital outlay surtax must be based on capital outlay full-time equivalent enrollment (COFTE), rather than the total school district enrollment.

Vote: Senate 29-11; House 82-31

CS/CS/SB 846 — Agreements of Educational Entities with Foreign Entities

Higher ed foreign gifts (SB 846): Prohibiting state colleges, universities, and their employees from accepting gifts originating from “foreign countries of concern” — China, Cuba, Iran, North Korea, Russia, Syria and Venezuela.

This Florida legislation addresses agreements between educational entities within the state and foreign counterparts. The bill (Chapter 2023-34, L.O.F.) establishes requirements specific to state universities and Florida College System institutions (state colleges) with respect to receiving foreign gifts and entering into international cultural agreements.

The bill also prohibits state universities and state colleges from accepting any grant from or participating in either of the following with a foreign country of concern, or with any foreign principal:

- An agreement, defined as a written statement of mutual interest in academic or research collaboration, beginning July 1, 2023.

- A partnership, defined as a faculty or student exchange program, study abroad program, articulation program, recruiting program, or dual degree program, beginning December 1, 2023.

A state university or college may only participate in an agreement or partnership with a college or university based in a foreign country of concern, or with a foreign principal, if authorized by the Board of Governors (BOG) or the State Board of Education (SBE), respectively, and if the agreement satisfies certain other criteria required of all state agency cultural agreements.

The bill also:

- Authorizes the BOG or the SBE to impose statutory sanctions on, and withhold performance funding from, state universities or state colleges for unapproved partnerships or agreements.

- Requires the BOG and the SBE to submit a report to the Governor and the Legislature, annually by December 1, to include data on grants, agreements, partnerships, contracts, or physical locations with any foreign country of concern.

Lastly, the bill prohibits the ownership or operation of any private school participating in the state’s school choice scholarship program, by a person or entity domiciled in, owned by, or in any way controlled by a foreign country of concern or a foreign principal.

These provisions were approved by the Governor and took effect on July 1, 2023.

Vote: Senate 39-0; House 119-0

Tax Breaks (HB 7063) Taxation

The bill encompasses an array of tax incentives, such as establishing various sales-tax “holidays” and introducing sales-tax exemptions on items like diapers:

The bill:

- Permanently exempts from sales tax the sale of:

- Baby and toddler products, including diapers and wipes.

- Oral hygiene products.

- Adult incontinence products.

- Private investigative services by certain small private investigative agencies.

- Machinery and equipment used to produce, store, transport, compress, or blend renewable natural gas.

- Firearm storage devices.

- Certain cattle fencing.

- Provides two 14-day “back-to-school” sales tax holidays from July 24, 2023, through August 6, 2023, and January 1, 2024, through January 14, 2024, for certain clothing, school supplies, learning aids and puzzles, and personal computers.

- Provides two 14-day “disaster preparedness” sales tax holidays from May 27, 2023, through June 9, 2023, and August 26, 2023, through September 8, 2023, for specified disaster preparedness items.

- Provides a three-month “recreational” sales tax holiday (“Freedom Summer”) from May 29, 2023, through September 4, 2023, for specified admissions, boating and water activity supplies, camping supplies, fishing supplies, general outdoor supplies, residential pool supplies, children’s toys, and children’s athletic equipment.

- Provides a 7-day “tools” sales tax holiday from September 2, 2023, through September 8, 2023, for tools and equipment needed in skilled trades.

- Provides a one-year sales tax exemption from July 1, 2023, through June 30, 2024, for gas ranges and cooktops.

- Provides a one-year sales tax exemption from July 1, 2023, through June 30, 2024, for certain ENERGY STAR certified refrigerators, refrigerator/freezer combinations, water heaters, and clothes washers and dryers.

- Reduces the sales tax rate on commercial leases from 5.5 percent to 4.5 percent beginning December 2023, and lasting until the rate is permanently reduced to 2 percent in accordance with SB 50 (2021).

The bill:

- Expands the property tax exemption for educational property to include certain leased property.

- Redefines “first responder” to include federal law enforcement officers for purposes of the homestead exemption for totally and permanently disabled first responders and the homestead exemption for surviving spouses of first responders who die in the line of duty.

- Clarifies that parsonages, burial grounds, and tombs owned by an entity that owns a house of public worship are used for a religious purpose.

- Clarifies that totally and permanently disabled veterans and surviving spouses may transfer their existing homestead exemption to a new property.Allows totally and permanently disabled veterans and surviving spouses who purchase a new homestead in Florida to receive a refund of the taxes they paid in the year of purchase.

- Prohibits the imposition of special assessments on agricultural lands, except that special assessments that are currently pledged for bonds may continue until the bonds have been paid.

- Increases the property values and percentages of variance above which a property appraiser may appeal an assessment change made by a value adjustment board.

- Amends the totally and permanently disabled veteran homestead property tax exemption to incorporate a recent court decision.

The bill:

- Adopts the Internal Revenue Code in effect on January 1, 2023.

- Creates a temporary corporate income tax credit for expenses incurred in Florida in preparing a facility to produce human breast milk fortifiers.

- Creates a temporary corporate income tax credit for installing a graywater system on residential property in Florida.

- Clarifies that for purposes of calculating the underpayment penalty, contributions to tax donation programs are counted as payments of tax.

Documentary Stamp Tax and Intangible Personal Property Tax

The bill provides a documentary stamp and intangibles tax exemption for certain Small Business Administration 504 loans.

Various Taxes

The bill:

- Increases the annual limit for contaminated site rehabilitation (“brownfields”) tax credits from $10 million to $35 million.

- Delays Florida’s motor fuel tax on natural gas from January 1, 2024, until January 1, 2026.

- Freezes the local communications services tax rates until January 1, 2026.

- Authorizes a county to levy the local option food and beverage tax in a city or town that levies the municipal resort tax, if the levy is approved by referendum.

- Increases the annual cap on the Strong Families Tax Credit program by $10 million.

- Requires future levies of tourist development tax to be by referendum.

- Increases from 225,000 to 275,000 the population cap under which certain counties are authorized to use up to 10 percent of their tourist development tax receipts on public safety expenses necessitated by tourism.

- Authorizes certain fiscally constrained counties to use up to 10 percent of their tourist development tax receipts on public safety expenses necessitated by tourism.

- Distributes $27.5 million in sales tax receipts for two years for use by thoroughbred race tracks in Florida to promote thoroughbred racing and thoroughbred breeding in Florida.

- Creates a pari-mutuel tax credit equal to the amounts paid by Florida racetracks to the Horseracing Integrity and Safety Association.

- Updates various statutes that require taxes to be imposed by referenda to require that increases and reenactments of taxes be on the ballot in a general election within 48 months of the increase or reenactment becoming effective, and such referenda may be on the ballot only once during that 48 months.

- Appropriates $35 million to the Department of Revenue to reimburse local governments for the property tax refunds issued to property owners whose residential property was rendered uninhabitable by Hurricane Ian or Hurricane Nicole during calendar year 2022.

- Makes non-substantive clarifications to Florida’s statute that provides for property tax refunds related to property rendered uninhabitable.

Vote: Senate 38-0; House 112-0

Sources: https://www.flsenate.gov/

https://www.miamiherald.com/news/politics-government/state-politics/article276754411.html

The Guillen Pujol Team