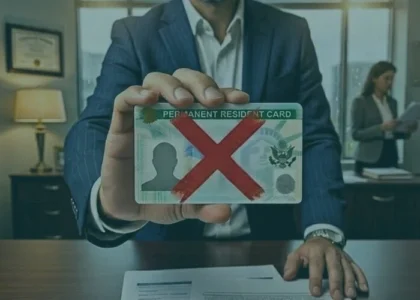

New 2026 SBA loan eligibility rules require 100% U.S. citizenship starting March 1st. See how this affects Green Card holders and your business's access to funding....

New 2026 SBA loan eligibility rules require 100% U.S. citizenship starting March 1st. See how this affects Green Card holders and your business's access to funding....